Arizona Short Term Health Insurance

A Short Term Medical Plan is temporary medical insurance that provides comprehensive protection against unexpected health care health care expenses. Policies can be purchased from 30 days up to 36 months. The application process is simple with only a few qualifying questions to answer and coverage can begin as early as the next day.

Short Term Medical Insurance is perfect for individuals who are:

- Recent college graduates (ASU – go devils!)

- Between jobs or laid off

- Waiting for employer-sponsored coverage

- Losing dependent status

- Looking for a lower-cost alternative to COBRA

- Recently retired and not eligible for Medicare

- On strike

Short Term Medical

![]()

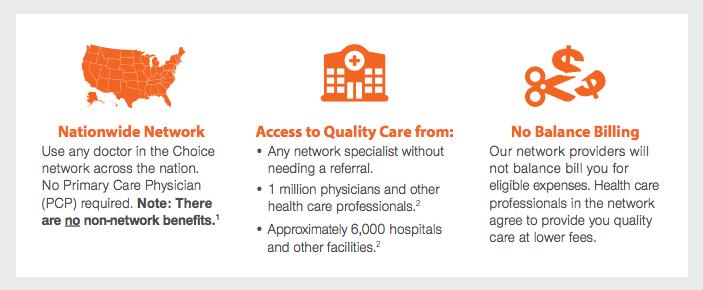

UHC PPO Provider Network

UnitedHealthCare Choice Network Advantages

United HealthOne Golden Rule plans use a large PPO network of doctors, hospitals, and other providers that offer you quality health care. Receive quality care at reduced costs because the network providers have agreed to lower fees for covered expenses. The large network of doctors and hospitals offer choices across the nation, so even when you’re traveling, you’re likely to find in-network care. You must use a network doctor or hospital unless it is an emergency.

Find A Doctor to search for UnitedHealthcare Choice network providers.

Key Points

- The enrollment fee is refundable should you cancel your plan within the free look period

- The definition of preexisting condition is replaced with: “Preexisting condition” means a condition for which the covered person received medical advice or treatment within the 12 months immediately preceding the date he or she became insured under the policy.

Find A Doctor to search for UnitedHealthcare Choice PPO network providers.

What's Covered

Ambulance Services

Ground ambulance service to a hospital for necessary emergency care.

Autism Spectrum Disorders

Outpatient applied behavior analysis limited to $50,000 per policy term, per covered person.

Dental Services

Dental expenses for an injury to natural teeth suffered after the coverage effective date. Expenses must be incurred within 6 months of the accident. No benefits payable for injuries due to chewing as limited in the policy.

Diabetes

- Diabetes equipment, supplies, and services.

- Diabetes self-management training when medically necessary as determined by a physician, prescribed by a physician, and provided by an appropriately licensed health care professional limited to:

- One diabetes self-management training program per covered person, per lifetime.

- Additional diabetes self-management training prescribed by a physician as medically necessary due to a significant change in the covered person’s symptoms or condition.

Diagnostic Testing

Durable Medical Equipment

Rental of wheelchair, hospital bed, and other durable medical equipment.

Home Health Care

Home health care prescribed and supervised by a doctor and provided by a licensed home health care agency. Covered expenses for home health aide services will be limited to 7 visits per week and a lifetime maximum of 365 visits. Benefits for home health care will not extend beyond the term of your plan. Each 8-hour period of home health aide services will be counted as one visit. Private duty registered nurse services will be limited to a lifetime maximum of 1,000 hours. Intermittent private duty registered nurse visits are not to exceed 4 hours each and are limited to $75 per visit (2 hours per visit are applied toward the lifetime maximum of registered nursing). No benefits payable for respite care, custodial care, or educational care.

Hospital Services

Daily hospital room and board at most common semiprivate rate; eligible expenses for an intensive care unit; inpatient use of an operating, treatment, or recovery room; outpatient use of an operating, treatment, or recovery room for surgery; services and supplies, including drugs and medicines, which are routinely provided in the hospital to persons for use only while they are inpatients; emergency treatment of an injury or illness. Covered expenses for use of the emergency room are subject to a copayment of $250 for each emergency room visit. Hospital does not include a nursing or convalescent home or an extended care facility.

Medical Supplies

Dressings and other necessary medical supplies. Cost and administration of an anesthetic or oxygen.

Newborn Care

- Routine in-hospital care of a newborn for the first five days or until the mother is released which ever occurs first.

- Pregnancy not covered, except for complications.

Outpatient Surgery Physician Fees

- Professional fees of doctors, medical practitioners, and surgeons.

- Assistant surgeon fee for a doctor, limited to 20% of eligible expenses of the procedure, and 14% of eligible expenses of the procedure for another medical professional acting as an assistant surgeon.

Preventive Care

- Children’s preventive health services for covered children as defined in the certificate.

- Colorectal cancer examinations, prostate-specific antigen testing, and other preventive care as required by your state and specified in the certificate.

Rehabilitation and Extended Care Facility (ECF)

Must begin within 14 days of a 3-day or longer hospital stay for the same illness or injury. Limited to 60 days per policy term for both rehabilitation and ECF expenses. Spine and Back Disorders Benefits for treatment of spine and back disorders limited to $250 per person, per policy term.

Spine and Back Disorders

Benefits for treatment of spine and back disorders limited to $250 per person, per policy term.

IHC Short Term Insurance

More About IHC

Company Information

IHC (Short for Independent Holding Company) is primarily known for their short term insurance, but they do offer a suite of other coverage, including great accident and critical illness riders that can be added to any short term OR regular health plan.

IHC offers 3 different short-term plan types, each good for different situations:

Connect Lite

Our Rating: ★☆☆☆☆

The least expensive and lowest level of coverage. These plans have caps on what they will pay for each individual service. Truly a catastrophic plan.

Best for: The most price sensitive, young people most unlikely to have to use it.

Connect STM

Our Rating: ★★★★☆

Middle-of-the-road coverage, with lots of flexibility in regards to deductibles and co-insurance. With less caps, higher co-insurance amounts and a $2 million max this will be the best option for most people.

Best for: Most healthy people (without pre-existing conditions), people between coverage or jobs

Connect Plus

Our Rating: ★★★★★

New!

Nearly identical to Connect plans, but with up to 25k in coverage for pre-existing conditions, this is the highest level of coverage you can get from a catastrophic plan, and to our knowledge the only short-term or catastrophic plan to do so.

Best For: Anyone with pre-existing conditions

Plan Comparison

| PLAN DESIGNS | CONNECT LITE | CONNECT STM | CONNECT PLUS | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| View Brochure | View Brochure | View Brochure | ||||||||||

| Apply Now | Apply Now | Apply Now | ||||||||||

| Office visit copay (one per coverage period) |

$50 | $50 | $50 | |||||||||

| Deductible | $1,000 $2,500 $5,000 |

$7,500 $10,000 |

$1,000 $1,500 $2,500 |

$5,000 $7,500 $10,000 |

$2,500 $5,000 |

$7,500 $10,000 |

||||||

| Coinsurance and out-of-pocket (not including deductible) | 20% $1,000 $2,000 $3,000 $4,000 |

50% $2,500 $5,000 $7,500 $10,000 |

20% $1,000 $2,000 $3,000 $4,000 |

30% $1,500 $3,000 $4,500 $6,000 |

50% $2,500 $5,000 $7,500 $10,000 |

20% $1,000 $2,000 $3,000 $4,000 |

30% $3,000 $4,500 $6,000 |

50% $2,500 $5,000 $7,500 $10,000 |

||||

| Pre-existing condition coverage period maximum |

Not covered | Not covered | $25,000 After maximum is reached, expenses due to pre-existing conditions are not covered. |

|||||||||

| Maximum benefit | $1,000,000 | $2,000,000 | $2,000,000 | |||||||||

| Covered Expenses | Connect Lite | Connect STM | Connect Plus | |||||||||

| Hospital room, board and general nursing care | The amount billed for a semi-private room or 90% of the private room billed amount, not to exceed $5,000 per day. | The amount billed for a semi-private room or 90% of the private room billed amount | The amount billed for a semi-private room or 90% of the private room billed amount | |||||||||

| Intensive care unit | Three times the amount billed for a semi-private room or three times 90% of the private room billed amount, not to exceed $6,250 per day | Three times the amount billed for a semi-private room or three times 90% of the private room billed amount |

Three times the amount billed for a semi-private room or three times 90% of the private room billed amount |

|||||||||

| Surgeon services |

Not to exceed $2,500 per surgery |

Deductible and coinsurance | Deductible and coinsurance | |||||||||

| Anesthesiologist | Not to exceed 20% of the surgeon’s benefit | Not to exceed 20% of the surgeon’s benefit | Not to exceed 20% of the surgeon’s benefit | |||||||||

| Assistant surgeon | Not to exceed 20% of the surgeon’s benefit | Not to exceed 20% of the surgeon’s benefit | Not to exceed 20% of the surgeon’s benefit | |||||||||

| Surgeon’s assistant | Not to exceed 15% of the surgeon’s benefit | Not to exceed 15% of the surgeon’s benefit | Not to exceed 15% of the surgeon’s benefit | |||||||||

| Inpatient doctor visits | Not to exceed $500 per confinement | Deductible and coinsurance | Deductible and coinsurance | |||||||||

| Outpatient hospital surgery or ambulatory surgical center |

Not to exceed $1,000 per day | Deductible and coinsurance | Deductible and coinsurance | |||||||||

| Emergency room | Not to exceed $500 per day | Deductible and coinsurance | Deductible and coinsurance | |||||||||

| Ambulance, ground or air services | Not to exceed $250 per occurrence | Ground: Not to exceed $500 per occurrence Air: Not to exceed $1,000 per occurrence |

Ground: Not to exceed $500 per occurrence Air: Not to exceed $1,000 per occurrence |

|||||||||

| Organ, tissue or bone marrow transplants |

Not to exceed $150,000 for all covered expenses | Not to exceed $150,000 for all covered expenses | Not to exceed $150,000 for all covered expenses | |||||||||

| Acquired Immune Deficiency Syndrome (AIDS) | Not to exceed $10,000 for all covered expenses | Not to exceed $10,000 for all covered expenses | Not to exceed $10,000 for all covered expenses | |||||||||

IHC Provider Network

PHCS – Limited * is one of the nation’s largest networks with more than 500,000 members in 50 states, including physicians, and inpatient and outpatient facilities.

![]()

*ACS and PHCS are not affiliated with Standard Security Life Insurance Company of New York, nor are they part of this insurance plan.

Eligibility

Secure Lite and Secure STM are available to all members of from age 18 to 64, their spouse age 18 to 64 and dependent children up to age 26. Each applicant must qualify based on the plan’s application questions and underwriting guidelines. Child-only coverage is available for children age 2 up to age 18.

National General Short Term Medical

More About National General

Company Information

National General’s Short Term Medical insurance gives you a plan to face those unpredictable moments in life with confidence. It provides the financial protection you need from unexpected medical bills and other health care expenses, including:

- Doctor visits and some preventive care

- Emergency room and ambulance coverage

- Urgent care benefits, and more

National General Health Insurance Feature Highlights

- Coverage Period Maximum of $250,000 and $1,000,000

- Deductible options of $1,000, $2,500, or $5,000

- Coinsurance Percentage of In-Network plan 100/0, 80/20 and 50/50

- Doctor Office Visit and Urgent Care Co-pay of $50

- Access to Aetna’s National Open Access PPO Network

Standard Issue Plans

| Deductible* | Coinsurance | Out-Of-Pocket Max | Coverage Period Max |

|---|---|---|---|

| $1,000 | 50% / 50% | $2,500 | $250,000 |

| 80% / 20% | $1,500 | $1,000,000 | |

| $2,500 | 50% / 50% | $2,500 | $250,000 |

| 80% / 20% | $1,500 | $1,000,000 | |

| 100% | $0 | $1,000,000 | |

| $5,000 | 50% / 50% | $3,750 | $250,000 |

| 80% / 20% | $2,000 | $1,000,000 | |

| 100% | $0 | $1,000,000 | |

| $10,000 | 100% | $0 | $1,000,000 |

| $25,000 | 100% | $0 | $1,000,000 |

* Per-person deductible and out-of-pocket amounts are capped at 3x the individual amounts for a family greater than three. This means that when three insured family members satisfy their individual deductibles and out-of-pocket amounts, the remaining individual deductibles and out-of-pocket amounts will be deemed as satisfied for the remainder of the coverage term. Short Term Medical plans do not cover costs associated with pre-existing conditions.

National General Provider Network

Choose Your Provider

National General’s Short Term Medical insurance gives you access to the Aetna Open Choice PPO network, one of the largest networks in the country with no referral required.

Short Term Health Insurance and Network Breadth

While more than half of ACA plans lack out-of-network coverage,14 all short term insurance plans offered through National General have broad network coverage ensuring that an enrollee has access to quality health care providers.

Short Term insurance plan premiums are also significantly less expensive than unsubsidized premiums for health plans sold on the exchanges. Compared to the average costs for 2019 Obamacare bronze plans for individuals aged 30, 40, and 50, short term insurance plans are 25 percent less expensive. Savings are greater for younger individuals without pre-existing conditions. For healthy males, aged 30, a short term insurance premium is 54.93% less expensive than an Obamacare Bronze plan.

It should be noted that unlike ACA plans, short term insurance plans do not cover medical conditions that existed 12 months prior to enrollment.

Short Term Health Insurance FAQ

How Is Short Term Health Insurance Different Than Obamacare?

Affordable Care Act plans typically have broader benefits than found in Short Term health insurance and, without the premium subsidies available to some qualified purchasers, cost much more than Short Term plans.

All health plans that fit in the Affordable Care Act must have “10 Essential Health Benefits.” Short Term health insurance plans, in comparison, do not have a standardized set of benefits. Short Term plans usually offer what would be described as “major medical coverage” that covers healthcare costs in the event of serious medical issues. Most Short Term plans also cover normal doctor visits for routine illnesses and injuries.

Considering the prevalence of ACA insurance plans with narrow networks, consumers should heavily research plans before enrolling to ensure that they are not putting themselves at risk for high out-of-network costs.

For those needing broad coverage, short term insurance may be a good option. 100% of short term insurance plans sold through Independent Health Agents have out-of-network coverage. Enrollees in these plans can be ensured that they will have access to high quality providers without incurring unknown and potentially sizable costs.

The chart below details some of the major benefit differences between Short Term health insurance plans and Affordable Care Act plans. It is important to note that Affordable Care Act plans do not deny care for pre-existing conditions nor do they reject applicants based on health problems.

| Short Term Health Insurance Plans | Affordable Care Act Plans | |

| Coverage availability | Apply any time and get coverage as early as the next day | Apply only during Open Enrollment (or Special Enrollment due to a qualifying event) and get coverage in 2-6 weeks |

| Coverage duration | Coverage duration is less than three months. Many plans can be cancelled at any time. | As long as the plan is available. You can change plans during Open Enrollment (or Special Enrollment with a qualifying event) |

| Prescription drug coverage | Many Short Term health insurance plans provide a drug discount card but do not provide drug coverage. Some newer plans have a prescription drug coverage option for generic drugs not associated with a pre-existing condition. Brand name drugs and specialty drugs are typically uncovered. | Minimum of 1 drug per class must be covered but the minimum number of drugs per class is often more due to the benchmark chosen for each particular state. |

| Maternity and newborn care | Complications of maternity are covered but not standard childbirth services. | Full coverage. Applicants cannot be denied based on pregnancy as a precondition. |

| Mental health services | Coverage is included only when mandated at state level. | Coverage included, but states vary on their definition of “mental health” services, so while some do include learning disabilities or conditions like Autism, other states do not. |

| Substance use disorder services | Coverage is included only when mandated at state level. | All ACA plans have full coverage. |

| Rehabilitative and habilitative services | Coverage is included only when mandated at state level. | All ACA plans have full coverage. |

| Preventive care | Some plans have selected preventive care benefits with cost-sharing. However, most plans do not cover preventive care services. | Preventative services must be provided without cost-sharing (cf.https://www.healthcare.gov/preventive-care-benefits) |

| Pediatric services – oral and dental care | Coverage is included only when mandated at state level. | All ACA plans have full coverage. |

| Healthcare provider networks | Short Term plans typically have broad acceptance among healthcare providers. Some have a preferred network with negotiated pricing for healthcare services and a larger non-preferred network where the plans pay ‘usual and customary’ fees for covered healthcare. | These plans have been noted for a significant use of “narrow networks” to increase the ratio of enrollees to healthcare providers. |

| Uninsured tax penalties | The maximum penalty is the national average premium for a bronze plan. For 2019, the tax penalty is no longer | ACA plans meet the requirements for avoiding the tax penalty. |

| Coverage of pre-existing conditions | These plans evaluate health status and pre-existing conditions when processing an insurance application and determine whether the applicant is approved or rejected for coverage. | These plans do not consider health status or pre-existing conditions when processing an insurance application. |

Is short-term health insurance Obamacare?

In addition, short-term health insurance involves an application. Depending on your health status, your application may be declined or your pre-existing condition may be excluded. Obamacare guarantees that all applicants and their pre-existing conditions will be covered, no matter what your health status.

When can I apply for short-term health insurance?

You can apply at any time. There is no fixed open enrollment period. On arizonahealthagents.com, you can submit your application and, if approved, your insurance can be effective within as little as 24 hours.

Can I cancel a short term plan at any time?

What conditions on the application will make me ineligible for a short term plan?

Within the last 5 years if you have been diagnosed, treated, or taken medication for any of the following conditions, term health insurance cannot be issued: Cancer or tumor, stroke, heart disease including heart attack, chest pain or had heart surgery, COPD (chronic obstructive pulmonary disease) or emphysema, Crohn’s disease, liver disorder, degenerative disc disease, rheumatoid arthritis, kidney disorder, diabetes, degenerative joint disease of the knee, alcohol abuse or chemical dependency, or any neurological disorder; HIV or AIDS; or if you are now pregnant or in the process of adoption.

If you are looking for insurance to cover your pre-existing conditions, we can refer you to an agent who can help you find a health insurance plan that to cover these conditions:

- For ACA/Obamacare Plans: 312-726-6565

What To Know:

- Plans for as little as 30 days up to 36 months. Can cancel anytime

- Large PPO networks available

- Doesn’t cover pre-existing conditions

- Additional add-on options for accident protection, prescriptions and more