UHC Hospital & Indemnity Coverage

Underwritten by Golden Rule Insurance Co

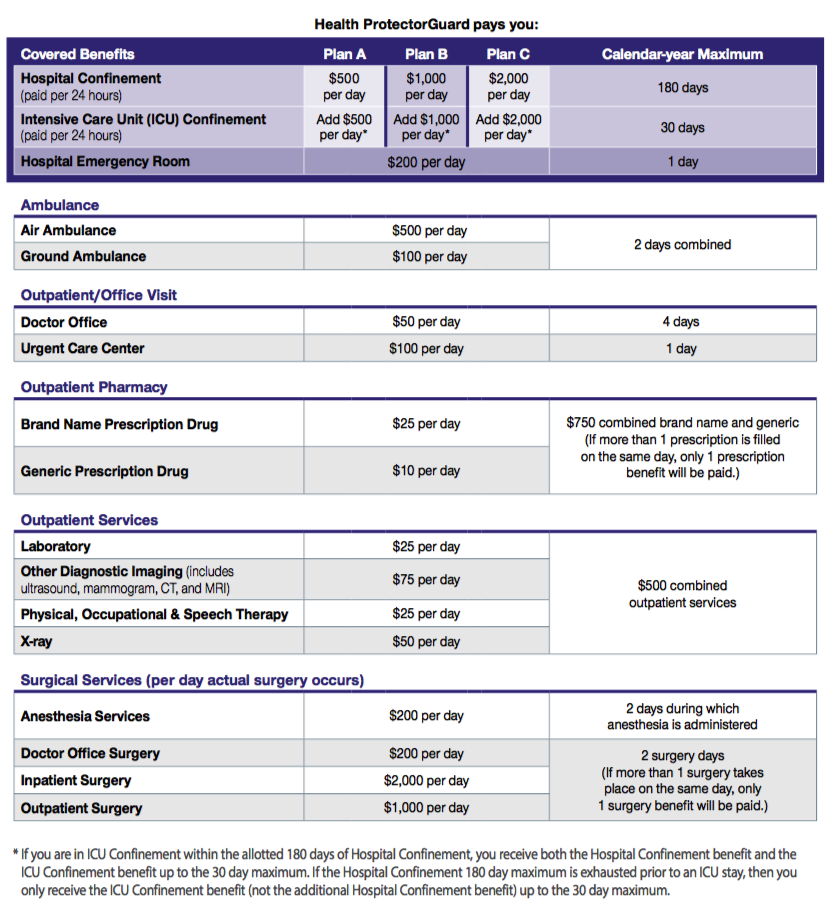

Health ProtectorGuard plans are designed to supplement health insurance and assist you with costs incurred from hospital services, helping to lower their out-of-pocket expenses.

These UHC plans pay a fixed amount per day for Hospital Confinement, ICU Confinement, Emergency Room, plus other medical services up to the calendar year maximum.

You can pair these plans with a regular health insurance plan to protect yourself from unexpected costs and lower your out-of-pocket expenses, including a High Deductible Health Plan.

Our Rating: ★★★★☆

Why should I consider this coverage?

The cost of medical care, especially a hospital stay, can add up quickly. Even if you have health insurance — deductibles, copays, and coinsurance can take a big bite out of your budget. Without insurance, your out-of-pocket costs can be even greater. Health ProtectorGuard can fill the gaps in your health coverage by providing cash to help pay for your deductible and non-covered expenses from a hospital stay, surgical services, ambulance, even labs and X-rays, regardless of your health insurance coverage.

With Health ProtectorGuard:

- Benefit payments are paid in a lump sum directly to you and can be used however you like. Save them, pay medical bills, or even use them to help cover living expenses like groceries, mortgage/rent, and child care.

- You are not limited by provider networks.

- You will be paid the same amount no matter what provider you choose to see.

- There is no deductible or waiting period to meet prior to receiving benefit payments.

- Coverage available for individual or entire family.

- Guaranteed renewable to age 6

- Lifetime maximum benefit: $1,000,000 per covered person.

What To Know

![]()

No network limitations.

![]()

No deductible or waiting period.

![]()

Renewable coverage until age 65.

You select the hospital confinement benefit level to determine your base premium. We’ll provide you with claim forms to complete and send in. You attach copies of your receipts for the items listed below and we issue you a check to use as you see fit. This coverage provides benefits in a stated amount for confinement in a hospital, regardless of the hospital expenses actually incurred by the insured, due to such confinement.

Health ProtectorGuard Benefits

This product provides limited benefits. Health ProtectorGuard is not major medical or comprehensive health insurance and does not provide the mandated coverage necessary to avoid a penalty under the Affordable Care Act.

Hospital Confinement

We will pay the Inpatient Hospital Confinement Benefit amount per covered person, for each day charged for hospital confinement as an inpatient under the orders of a doctor. Limited to 180 days per covered person, per calendar year.

Intensive Care Unit Confinement

We will pay the Intensive Care Unit Benefit for each day a covered person is charged for confinement in an intensive care unit as an inpatient under the orders of a doctor. Limited to 30 days per covered person, per calendar year.

Hospital Emergency Room

We will pay the Hospital Emergency Room Benefit amount, limited to once per covered person, per calendar year, for a charge for hospital emergency room care.

Ambulance

We will pay the Ambulance Benefit amount for each day a licensed professional ground or air ambulance service is used to transport a covered person to a hospital or emergency care facility due to an illness or injury.

The Ambulance Benefit is limited to:

• 2 days per covered person, per calendar year.

• Emergency transportation or transportation between hospitals during a period of hospital confinement.

Doctor Office

United HealthOne will pay the Office Visit Benefit amount for each day a covered person is charged for an office visit rendered in a doctor’s office while the covered person is not an inpatient. Limited to 4 days per covered person, per calendar year.

No benefits are payable for doctor office visits that relate solely to alternative treatments, including acupressure, acupuncture, aroma therapy, hypnotism, massage therapy, rolfing, and other forms of alternative treatment as defined by the Office of Alternative Medicine of the National Institutes of Health.

Urgent Care Center

We will pay the Urgent Care Center Benefit amount, limited to once per covered person, per calendar year, for urgent care received in an urgent care center.

Outpatient Pharmacy

We will pay the Outpatient Prescription Drug Benefit amount each day a covered person is charged for an outpatient prescription drug prescribed by a doctor and dispensed at a licensed pharmacy, while the covered person is not an inpatient. Limited to a maximum of $750 combined for brand name and generic prescriptions per covered person, per calendar year.

If a covered person is charged for one or more prescription drugs on the same day, we will pay only one Outpatient Prescription Drug Benefit amount for that day. The amount payable will be the larger amount for that day.

“Prescription drug” means any medicinal substance whose label is required to bear the legend “Rx only.”

What's Not Covered (all plans)

General Exclusions

Benefits will not be paid for services or supplies that are not administered or ordered by a doctor and medically necessary to the diagnosis or treatment of an illness or injury, as defined in the policy.

No benefits are payable for expenses:

-

- For non-emergency services or supplies received from a provider who is not a network provider, except as specifically provided for by the policy.

- For a preexisting condition — A condition:

(1) for which medical advice, diagnosis, care, or treatment was recommended or received within the 24 months immediately preceding the date the covered person became insured under the policy/certificate; or (2) that had manifested itself in such a manner that would have caused an ordinarily prudent person to seek medical advice, diagnosis, care, or treatment within the

12 months immediately preceding the date the covered person became insured under the policy/certificate.

-

- A pregnancy existing on the effective date of coverage will also be considered a preexisting condition.

- NOTE: Even if you have had prior Golden Rule coverage and your preexisting conditions were covered under that plan, they will not be covered under this plan.

- That would not have been charged if you did not have insurance.

- Incurred while your coverage is not in force.

- Imposed on you by a provider (including a hospital) that are actually the responsibility of the provider to pay.

- For services performed by an immediate family member.

- That are not identified and included as covered expenses under the policy/certificate or are in excess of the eligible expenses.

- For services that are not covered expenses.

- For services or supplies that are provided prior to the effective date or after the termination date of the coverage.

- For weight modification or surgical treatment of obesity, including wiring of the teeth and all forms of intestinal bypass surgery.

- For breast reduction or augmentation.

- For drugs, treatment, or procedures that promote conception.

- For sterilization or reversals of sterilization.

- For fetal reduction surgery or abortion (unless life of mother would be endangered).

- For treatment of malocclusions, disorders of the temporomandibular joint (TMJ) or craniomandibular disorders.

- For modification of the physical body in order to improve psychological, mental, or emotional well-being, such as sex-change surgery.

- Not specifically provided for in the policy, including telephone consultations, failure to keep an appointment, television expenses, or telephone expenses.

- For marriage, family, or child counseling.

- For standby availability of a medical practitioner when no treatment is rendered.

- For hospital room and board and nursing services if admitted on a Friday or Saturday, unless for an emergency, or for medically necessary surgery that is scheduled for the next day.

- For dental expenses, including braces and oral surgery, except as provided for in the policy/certificate.

- For cosmetic treatment.

- For reconstructive surgery unless incidental to or following surgery or for a covered injury, or to correct a birth defect in a child who has been a covered person since childbirth until the surgery.

- For diagnosis or treatment of learning disabilities, attitudinal disorders, or disciplinary problems.

- For diagnosis or treatment of nicotine addiction.

- For charges related to, or in preparation for, tissue or organ transplants, except as expressly provided for under Transplant Services.

- For high-dose chemotherapy prior to, in conjunction with, or supported by ABMT/BMT, except as specifically provided under the Transplant Expense Benefits provision.

No benefits are payable for expenses:

-

- For eye refractive surgery, when the primary purpose is to correct nearsightedness, farsightedness, or astigmatism.

- While confined for rehabilitation, custodial care, educational care, nursing services, or while at a residential treatment facility, except as provided for in the policy/ certificate.

- For eyeglasses, contact lenses, hearing aids, eye refraction, visual therapy, or any exam or fitting related to these devices, except as provided for in the policy/ certificate.

- Due to pregnancy (except complications), except as provided in the policy/certificate.

- For diagnostic testing while confined primarily for well-baby care, except as provided in the policy/certificate

-

- For treatment of mental disorders or substance abuse including court-ordered treatment for programs, except as provided in the policy/certificate.

- For preventive care or prophylactic care, including routine physical examinations, premarital examinations, and educational programs, except as provided in the policy/ certificate.

- Incurred outside of the U.S., except for emergency treatment.

- Resulting from declared or undeclared war; intentionally self-inflicted bodily harm (whether sane or insane); or participation in a riot or felony (whether or not charged).

- For or related to durable medical equipment or for its fitting, implantation, adjustment or removal or for complications therefrom, except as provided for in the policy/certificate.

- For outpatient prescription drugs, except as provided for in the policy/certificate.

- For surrogate parenting

- For treatments of hyperhidrosis (excessive sweating).

- For alternative treatments, except as specifically covered by the policy/certificate, including: acupressure, acupuncture, aromatherapy, hypnotism, massage therapy, rolfing, and other alternative treatments defined by the Office of Alternative Medicine of the National Institutes of Health.

- If you entered into a settlement that waives your right to recover future medical benefits under a workers’ compensation law or insurance plan, this exclusion will still apply.

- Resulting from intoxication, as defined by state law where the illness or injury occurred, or while under the influence of illegal narcotics or controlled substances, unless administered or prescribed by a doctor.

- For joint replacement, unless related to an injury covered by the policy/certificate.

- For non-emergency treatment of tonsils, adenoids, hemorrhoids or hernia.

- For injuries sustained during or due to participating, instructing, demonstrating, guiding, or accompanying others in any of the following: sports (professional, or semi-professional, or intercollegiate except for intramural), parachute jumping, hang-gliding, racing or speed testing any motorized vehicle or conveyance, scuba/skin diving (when diving 60 or more feet in depth), skydiving, bungee jumping, or rodeo sports.

- For injuries sustained during or due to participating, instructing, demonstrating, guiding, or accompanying others in any of the following if the covered person is paid to participate or to instruct: operating or riding on a motorcycle, racing or speed testing any non-motorized vehicle or conveyance, horseback riding, rock or mountain climbing, or skiing.

- For injuries sustained while performing the duties of an aircraft crew member, including giving or receiving training on an aircraft.

- For vocational or recreational therapy, vocational rehabilitation, or occupational therapy, except as provided for in the policy/certificate.

- Resulting from experimental or investigational treatments, or unproven services.

Resulting from or during employment for wage or profit, if covered or required to be covered by workers’ compensation insurance under state or federal law.